You imagine one to a previous bankruptcy proceeding otherwise foreclosures manage prevent you against to order a house, however, luckily for us, that’s not the scenario. If you will need to stay glued to specific wishing periods, you could potentially nevertheless qualify for almost any mortgage, as long as you meet with the needed credit and you will earnings qualifications.

The new FHA’s prepared symptoms are among the shortest. The criteria to own recognition along with is faster strict, commonly leading them to an even better choice having consumers having a beneficial foreclosure otherwise case of bankruptcy tainting its number.

FHA Financing Just after Chapter 7 Case of bankruptcy

A bankruptcy proceeding personal bankruptcy should be recorded by one another businesses and folks that is called liquidation bankruptcy proceeding. It has been used to discharge considerable amounts from un-secured debts such as for instance playing cards, scientific expense, an such like. Within the A bankruptcy proceeding personal bankruptcy, another person’s assets and you can possessions can be bought away from, on continues going to the one creditors. Particular expense, particularly alimony, child service and also certain student loans, are completely forgiven lower than these personal bankruptcy.

Regarding closure into a mortgage into FHA, Chapter 7 personal bankruptcy requires a-two-season prepared several months. There are certain exceptional products for which you you will qualify in the course of time, whether or not. Any of these were:

- An urgent situation one lead to the fresh new reduction of household income because of the 20 percent or maybe more for around 6 months

- Brand new death of a partner

- A life threatening illness

- Jobs loss

- Pure emergency

Overall, if the a borrower try compelled to declare bankruptcy on account of a beneficial one-date feel you http://www.paydayloansconnecticut.com/route-7-gateway/ to definitely resulted in earnings losses, they truly are recognized for an enthusiastic FHA loan as quickly as 1 year just after submitting. A typical example of this could be when someone had a sudden scientific disaster you to definitely necessary comprehensive (and you can pricey hospitalization. Whether or not it triggered occupations losses, prices them several thousand dollars and made them not able to spend both scientific debts or any other bills, they might have obtained so you can declare themselves bankrupt away from need. Thus, the new bankruptcy doesn’t invariably mirror their overall creditworthiness once the a debtor.

Remember that lenders have their particular borrowing from the bank underwriting direction. Particular might not envision extenuating circumstances otherwise be prepared to move forward up until consumers try past one a couple-seasons draw post-release.

FHA Finance After Part 13 Personal bankruptcy

Chapter thirteen bankruptcy proceeding varies because the individual doesn’t have their expenses totally cleaned clean or their house liquidated. Instead, it invest in a repayment package and certainly will look after possession regarding their possessions and you may assets whenever you are paying down its debts. Section 13 constantly relates to merging expenses with the that large balance.

In the event that applying for a loan for the FHA, Chapter 13 filers might only need to wait 12 months. Direction and you may principles can differ by bank.

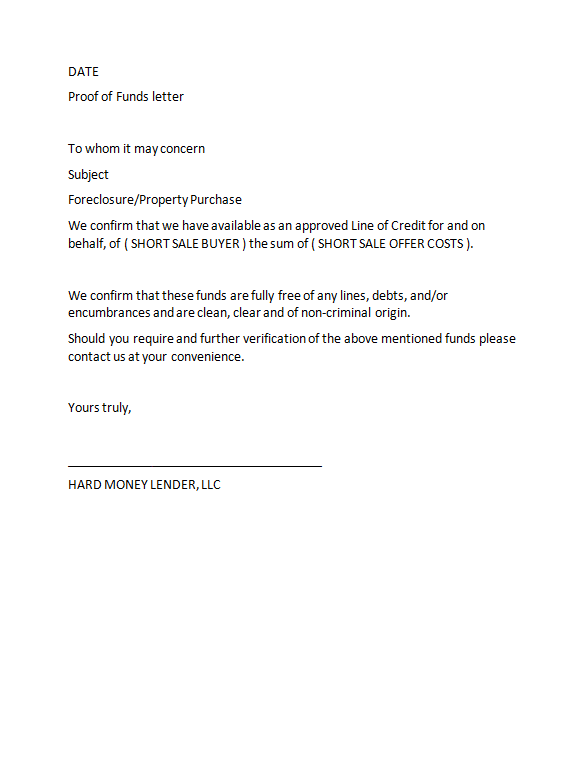

FHA Assistance to possess Property foreclosure

If you get at the rear of on the mortgage payments towards the a home, the financial institution takes arms of the home, fundamentally selling they and work out up because of their losses. This is certainly called a property foreclosure, and although it truly isn’t really a dazzling recommendation for your forthcoming mortgage lender, you could however be eligible for an FHA financing down the line.

Like with a bankruptcy, try to hold off a lot of day in advance of applying. For people who foreclosed to the a mortgage backed by the fresh new FHA, Virtual assistant otherwise USDA, your waiting several months is dependent on CAIVRS — the financing Aware Confirmation Reporting Program.

Usually, you have a three year prepared several months until you can apply for the next FHA financing. Which is much more less compared to the seven many years you’ll be able to typically must waiting to help you safe a conventional loan.

If you also proclaimed personal bankruptcy, the latest timing of foreclosures will have a job when you look at the qualifications, as well. Recommendations for coping with an article-personal bankruptcy foreclosures may vary because of the lender or any other factors.

Credit-Building Tips

After either a case of bankruptcy or foreclosure, your primary goal will be to establish your borrowing. In the event that taking out a loan was anywhere in your radar, you should show off your coming financial that you will be a professional, trustworthy debtor who helps make repayments timely, everytime.

However are unable to boost your credit score instantaneously, there are a few ways you can slowly improve your count — as well as your interest another lender — over time.

- Build automatic money or fee reminders. Commission history performs a big part in your credit rating, thus don’t let on your own fall behind. Pay their bills monthly, into due date, regardless of how quick the amount are. If you can, arranged automated repayments from your own family savings. That it guarantees you don’t miss a fees.

- End including alot more financial obligation. Do not add energy to the flames because of the racking up bank card loans or and also make larger orders. Monitor your cash circulate, adhere a funds and prevent opening any the latest funds otherwise profile. Focus on decreasing the debt you currently have, in the event you will be merely to make small dings at once.

- Be consistent. Play the role of given that consistent that one may on your borrowing activity. Instantly ounts is also upload up a warning sign, as well as accumulating tons of debt in one single week. Avoid taking right out any money enhances too, since these indicate economic worry is on the latest panorama.

- Get your credit use around 30 percent. You generally want to make use of lower than a third of one’s overall borrowing accessibility, very reduce the money you owe unless you struck which endurance. Lowest borrowing from the bank application shows you are responsible together with your fund, and it can assist your score as well as your odds within another mortgage.

As well as, dont close borrowing profile once you pay them out of. That will help lengthen your credit score, which is another type of positive basis having credit scores.

If you’re worried about the fresh urge to utilize you to definitely card once more, cut it up-and throw it about scrap. It can continue to exist in your credit history — just not in your pocketbook.