Virtual assistant loans are just available to veterans, active-duty service players, and you will qualified enduring partners, and come with multiple benefits. This type of experts tend to be a zero down-payment solution, no continuing mortgage insurance coverage responsibility, and lower rates of interest than just other mortgage loans.

Because U.S. Agencies off Pros Circumstances cannot establish a credit rating significance of the newest Va financing, participating lenders normally require minimums you to definitely start from 580 so you’re able to 660.

USDA financing

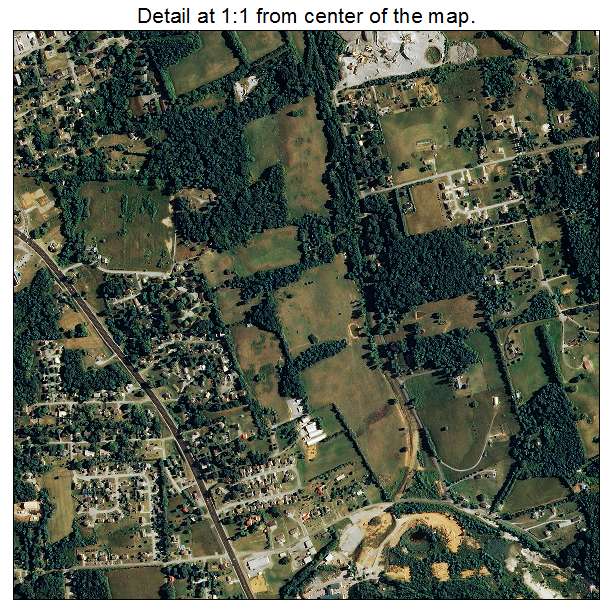

USDA financing was supported by the fresh new U.S. Agency out-of Farming (USDA). Zero down-payment is necessary. However need purchase inside the a designated outlying town (which includes 97% off America’s landmass) and possess the typical or less than-average earnings for the set in which you are interested.

You still have to invest home loan insurance costs that have USDA, however, in the less price than many other kind of money. Expect you’ll you want a credit history of 640 or more. This is certainly a great choice when the both you and our home meet the criteria. This option is an excellent options people looking to home loans having solitary mothers, considering both you and our home meet with the qualifications criteria.

State-work at financial software

As well, most of the says and lots of towns and cities and you may counties enjoys their family consumer programs, many of which promote down payment recommendations short term loans with bad credit Silverton of these which have qualifying lowest revenues. Lots of county-manage home loans depend on one or more of them listed above. Even so they will come which have lower interest levels or any other perks to own earliest-day home buyers. You will find a summary of county home client advice software right here.

Which family consumer program assists single mothers who happen to be also teachers, crisis scientific auto mechanics, the authorities, and you may firefighters. Because of Good neighbor Next door, qualifying customers appreciate up to fifty% off of the listing price, considering your house purchase is by using the latest U.S. Institution out-of Houses and Urban Invention (HUD).

HUD property are typically situated in revitalization components, that are meant to reinforce groups. Participants have to agree to residing the property for at least three years because their pri.

National Homeowners Finance

New Federal Homeowners Money is a low-profit houses company that provides affordable mortgage rates and down payment guidance for both coming back and you may basic-time people.

The application provides to 5% of your own home mortgage count inside down payment direction, to make homeownership much more accessible to own solitary moms. In addition, they provides various recommendations models, including features having single moms to purchase a home and you can second mortgage loans, some of which may not need cost, according to the buyer’s qualification therefore the particular terms of the new system.

Houses Options Discount System

Offered through get a hold of personal homes government, this voucher program offers personal homes citizens a route to homeownership as a result of the regional HUD system. Not merely will it assist defense month-to-month home loan repayments, but it addittionally will help having advance payment and closing costs, making the think of homeownership a real possibility for more solitary moms and dads.

The fresh new Property Alternatives Coupon System includes necessary homebuyer knowledge coaching so you can get ready participants towards the obligations out of homeownership. Consult your local houses power to find out if they gets involved during the software that provide gives to own single mothers to shop for a good household, and also to comprehend the particular qualifications conditions.

Homeownership for Social Casing People

This method authorizes personal property authorities in various states to offer products so you can established customers or other reduced-earnings households within its services urban area. It gives a different window of opportunity for unmarried moms staying in societal property so you can change on the homeowners, have a tendency to with positive economic terminology.