Daina B. was an experienced content writer having a talent getting taking a look at All of us housing industry trend. Their particular clear and you may enjoyable stuff helps website subscribers browse the reasons out-of selling and buying features.

Carol C. are a versatile editor, skillfully refining a property pleased with accuracy and you can invention. When not investigating field trend, the woman is absorbed regarding enthralling world of the latest cinema.

?? Editor’s Notice: Realtor Connectivity, representatives, and you may MLS’ have started using alter pertaining to the NAR’s $418 million settlement. While domestic-manufacturers may rescue thousands into the commission, conformity and you will litigation threats features rather improved to possess vendors regarding the country. Find out how NAR’s settlement influences home buyers.

As much as 83% off homebuyers play with FHA financing to acquire their fantasy family. Has just the latest FHA financing constraints have raised from the $twenty six,000. As per the revised guideline, the fresh FHA loan limit to possess unmarried-home buyers are $498,257 for the majority portion. Whereas into the highest-prices components the fresh new restriction can be are as long as $step 1,149,825.

These this new flexible restrictions Tennessee local banks for personal loans and you can low-down percentage of step three.5% generate FHA money a handy selection for your. FHA loans also provide a far more lenient credit history out-of only 580 versus old-fashioned finance.

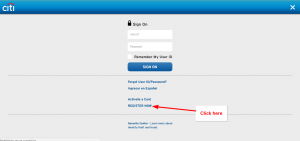

You can use top-notch lender’s help discover FHA fund. It help simplicity the process and you will schedule. Begin here! Find loan providers on the internet.

2024 FHA Financial Criteria

They offer versatile recommendations getting individuals which might not take advantage of old-fashioned financing. Here are the what you want to be prepared for:

- Advance payment: You should have at least advance payment away from step 3.5%. To see how which downpayment often affect your monthly obligations, you need to use a mortgage calculator to aid bundle your finances.

- Credit history: You should have the very least credit rating from 580 to help you acquire a keen FHA loan. Borrowers with a credit rating away from five hundred so you can 579 may still qualify however, would have to pay a downpayment away from ten%.

- Financial Cost: You have to pay an initial number of 1.75% of your own amount borrowed. You might spend the money for amount a-year otherwise separate they on weeks.

- Money and A job Records You need to have a two-seasons stable a position and income history.

- Debt-To-Income Ratio (DTI): You should go after a beneficial DTI proportion of 43% otherwise less. Some lenders could possibly get ensure it is to 50% for those who have a strong credit rating otherwise good discounts.

- Occupancy: FHA fund are just acknowledged to possess primary house and never having investment objectives.

- Domestic Assessment: FHA-approved appraisers will assess their residence’s really worth. They will look at whether it fits lowest defense and you will quality criteria.

Where to find The FHA Financing Limitation?

The fresh new Service out-of Casing and you can Urban Development (HUD) establishes constraints towards the FHA loans. They normally use a couple what to calculate financing limits: the type of property you happen to be to purchase and metropolitan analytical city it is located in.

Exactly how Is actually FHA Financing Restrictions Calculated?

If you find yourself these limitations are ready by HUD, it is not a single fixed number, it will vary based on these factors:

Suggestions to Search for an enthusiastic FHA Loan

Follow these tips so you can approach your FHA loan search with certainty. Get the best mortgage choice and come up with your own homeownership a reality.

Summation

FHA financing limits differ ranging from counties predicated on its average family sales rate. The FHA recommendations their constraints on a yearly basis. They revise all of them predicated on field conditions.

When you are an initial-date family client you should know the fresh new constraints set for brand new seasons and you will city you are interested in. You really must be prepared along with your documents and continue maintaining the absolute minimum credit score out-of 580.

If you are looking to possess a reduced deposit home loan and do not have the finest fico scores, a keen FHA loan makes it possible to. Be aware of the assistance and requirements that are included with these types of money.