Maybe you’ve seen a common people not able to create both their ends up meet even after working day and you may night? After you communicate with them, you recognise these include mad or sick and tired of changing ranging from its spots and you will satisfying a family group you need.

You will find heard of individuals waiting getting currency during the start of the times as opposed to the last big date or even in the first times of next month. They think that it more income available you will solve their difficulties. Naturally, I cannot replace the pattern of its businesses as they has actually their own reasons and you can logic.

So it enterprise is a simple mortgage service enabling pages so you can get finance easily versus probably banking institutions. What’s more, it reveals this new solutions getting profiles locate money to Rs 20,000 100% free and payback later – permitting all of them continue its lives immediately.

Pages have a problem with multiple efficiency items

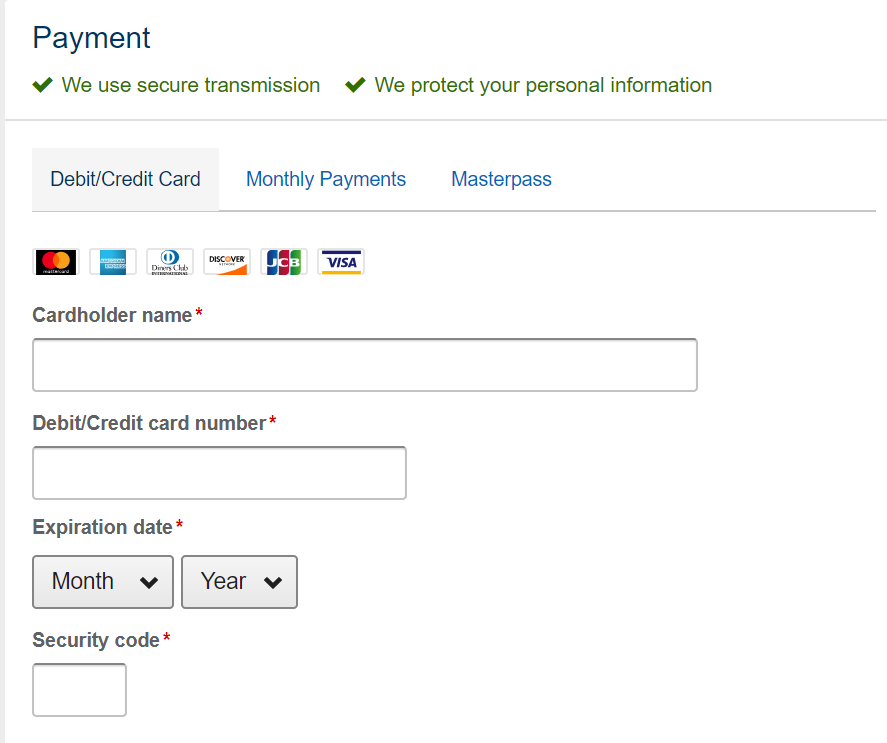

Member viewpoints indicated that it purchased points constantly from inside the bucks and you will the notion of having fun with a charge card try difficult for them while they need to pay particular normal cost to even explore this service membership. There’s along with an opportunity to miss out the due dates on their own while this software can also be publish them an indication.

- Loans from banks

- Household members

- Family

An excellent 2019 Borrowing from the bank Behaviour report off Bristol College or university offered tremendous notion on how income classification differs associate actions towards the loans.

Financing App for the lower-income class – Build Research study

- Property owners possess higher quantities of borrowing from the bank than simply non-residents

- Credit limit develops into the handmade cards and also make profiles feel he could be in charge however, top them towards the a demise-trap regarding money and you will fees

- Low-earnings domiciles is less likely to want to explore credit rating as opposed to those with the highest profits. Once they do obtain, this has been and come up with comes to an end meet and you can buy basics; and tend to be likely to explore highest-pricing lenders.

We grabbed such about three products since assumptions while deciding this new flow because they are mostly anticipated to work with a huge audience because they are dependent the analysis.

To stay away from going deep for the inspiration and you may strengthening an answer in the construction was not very productive because somewhere, users’ things and you may demands are untouched in this.

Loan App towards the lowest-earnings classification – Structure Research study

- They serves as a list and also make me adhere towards good reliable highway with enough independence to understand more about the latest size

- It assurances pages needs is actually found if you are inserting to your business lines

However, why should I wish to financing out of a company, in the place of likely to a bank while the cash is however good extremely personal topic and folks should not unusual out-by providing money out-of a lender for a few days while the taking loans means numerous process and you can takes some time?

One other choice were to loan off family members otherwise a buddy however, we don’t because they’re usually unsealed finished versus extremely obvious conversations and work out some thing hard once you face all of them the next time. And, this may destroy your own https://paydayloanalabama.com/south-vinemont/ relationships since it brings tension as soon as you see them and you feel like you borrowed from them a lot more currency.

While the dad regularly say: There are two yes a way to eradicate a friend, one is to help you acquire, one other so you’re able to give. ? Patrick Rothfuss, Title out-of Breeze

By this endeavor, we sought for to understand more about how exactly we can get financing easily in place of fretting about much more some thing than just paying down and carrying on its lives more effectively. Particularly targeting the next million users as they features a large amount of problems because of money, which will be fixed without being disrespected. They work very difficult to care for and you can improve their lives. The aim is to play people basic approach once the delivering a financing or speaking of debt updates remains forbidden.

I needed knowing more info on the challenge and therefore, the concept was to mention the reputation of other views so you’re able to lose every biases and to function with the information.