- Poor credit Loans

Youre at the 24fundsflow You can now fix your credit rating through getting the quintessential relevant product sales into less than perfect credit financing during the Ireland. You really have forgotten the first possibility to recover your bank account. Still, you are entitled to another options and curently have so it regarding united states.

Dont care about records, interest levels, money, or mortgage debt. Stay and you may settle down as the we have been flexible plus don’t impose one thing you. The process is paperless, and you will repayments is under control to the monthly money. All of our financing rates depend upon personal affordability.

I fill you up with our mortgage features, no invisible charge. You can aquire loans to have bad credit inside the Ireland with our company into basic loan amount ranging from 1000 to 10000. You might use the quantity to own a maximum time of 60 weeks. The fresh new carrying out identity is 1 year.

Analyse your current requires Understand the cost skill of your own month-to-month earnings Go for merely an easily affordable count Be mindful of your credit rating also

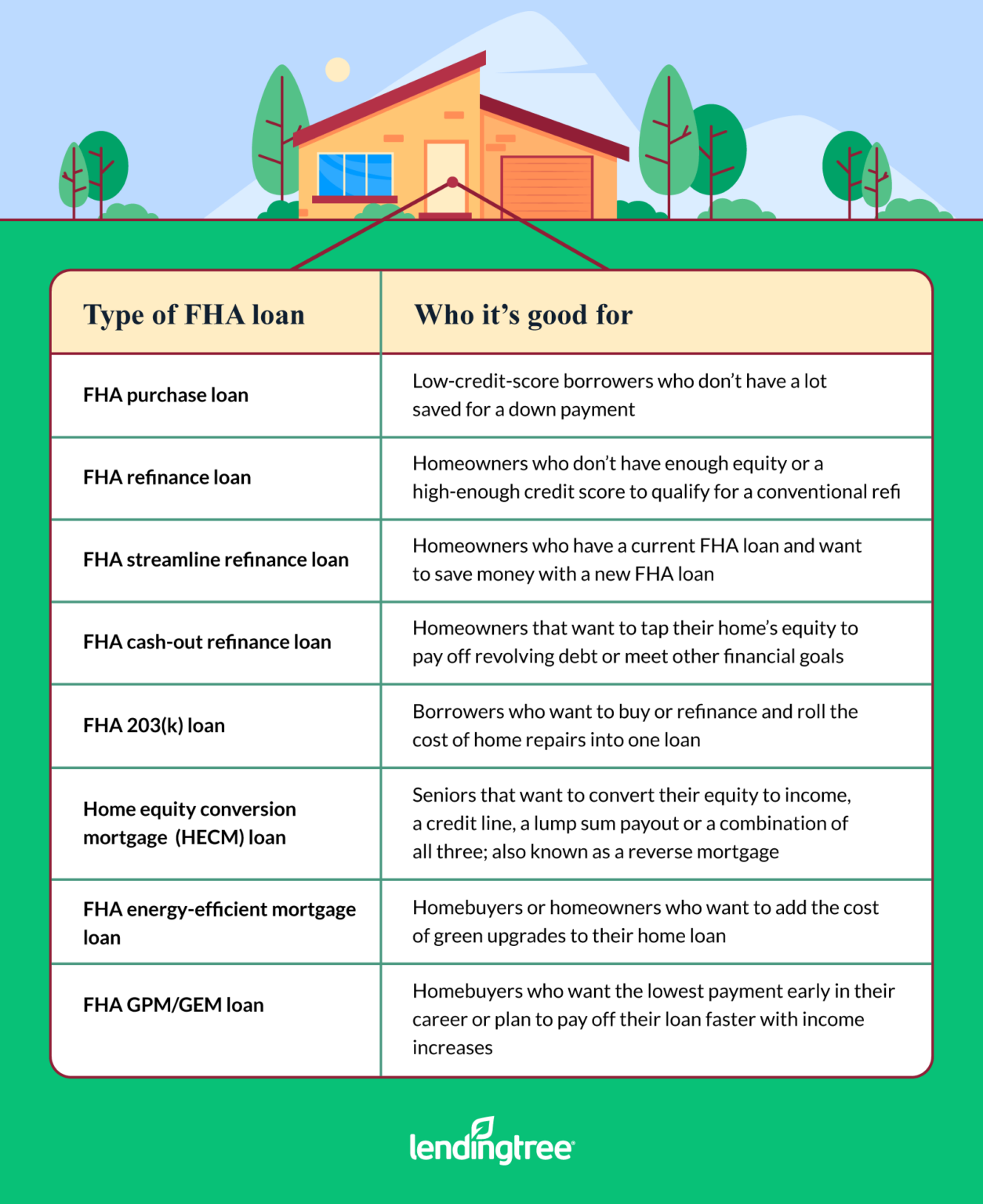

What about types of funds to have less than perfect credit on the web?

This type of unsecured loans getting bad credit really are this investment choice. I’ve translated all of them regarding specific’ so you’re able to special’ adding so much more kinds. Right here he or she is:-

Car loans: The amount of time is always to opt for our very own auto loans getting bad credit and fulfil your dream. Get a loan for vehicles design or afford the off payment. We could to make certain your out-of competitive interest rates.

Business Finance: I care for your online business expenses as well. We know of numerous begin-ups have the issue of bad credit. We are offered to giving business financing for bad credit into the Ireland.

Brief Finance: Our very own quick money for the Ireland having bad credit are useful in multiple suggests. These are good for monetary problems, and you may pay-off them each week or monthly.

Just what masters carry out I to get on the financing having poor credit?

Economic problems will stay if or not you have good credit otherwise terrible fico scores. Getting that loan that have good credit is quite convenient, however the difficulty appear an individual can be applied for a loan having bad credit on Ireland opportunities.

As opposed to almost every other private loan providers during the Ireland, we have been right here to help ease your loan fret through providing particular gurus. Talking about:-

No guarantee: Speaking of unsecured loans having bad credit some body and do not request people house in order to hope. It will be a threat-100 % free solution. As well as, your get small capital too.

Credit history improve: This type of loans will include flexible payment terminology. You could potentially like an expression on what you feel comfy go to this website settling. When you pay all instalments punctually, a critical update can be gradually show up on your credit history.

Top-up Mortgage Give: Predicated on your existing mortgage money, we’re going to offer a leading-right up loan to close it. You can acquire top interest rates, which is also ideal for your credit rating.

Flaccid Credit assessment: For each and every loan is subjected to the necessary credit check, which is flaccid. We take action just like the all of our finance are mainly predicated on present overall performance, maybe not previous mistakes. It will not lay out any lookup footprint in your credit reputation.

Approval off region-day money: People with bad credit scores commonly have a problem with earning difficulties. They don’t have to worry about us once we can also be agree its loan application into a member-time income.

Just how do loans to have bad credit relate with zero credit assessment?

Most people with less than perfect credit items is confused about whether or not to choose for poor credit financing otherwise prefer funds for the Ireland having no credit assessment. Each other loan choices are intent on individuals with smaller-than-primary credit scores.

A less than perfect credit loan is much more a specified mortgage device we bring really legally. Funds without tough borrowing checks into the Ireland require a whole lot more efforts regarding lenders and consumers.