Which is the better if you’d like to purchase property: A great Virtual assistant financing, FHA loan, otherwise a conventional mortgage? An instant address may look such as this:

Virtual assistant financing: Explore for those who have qualified You.S. army services, typically 3 months regarding active obligation otherwise half a dozen decades throughout the National Guard or Reserves. These types of money generally provide better costs and words than simply FHA or conventional.

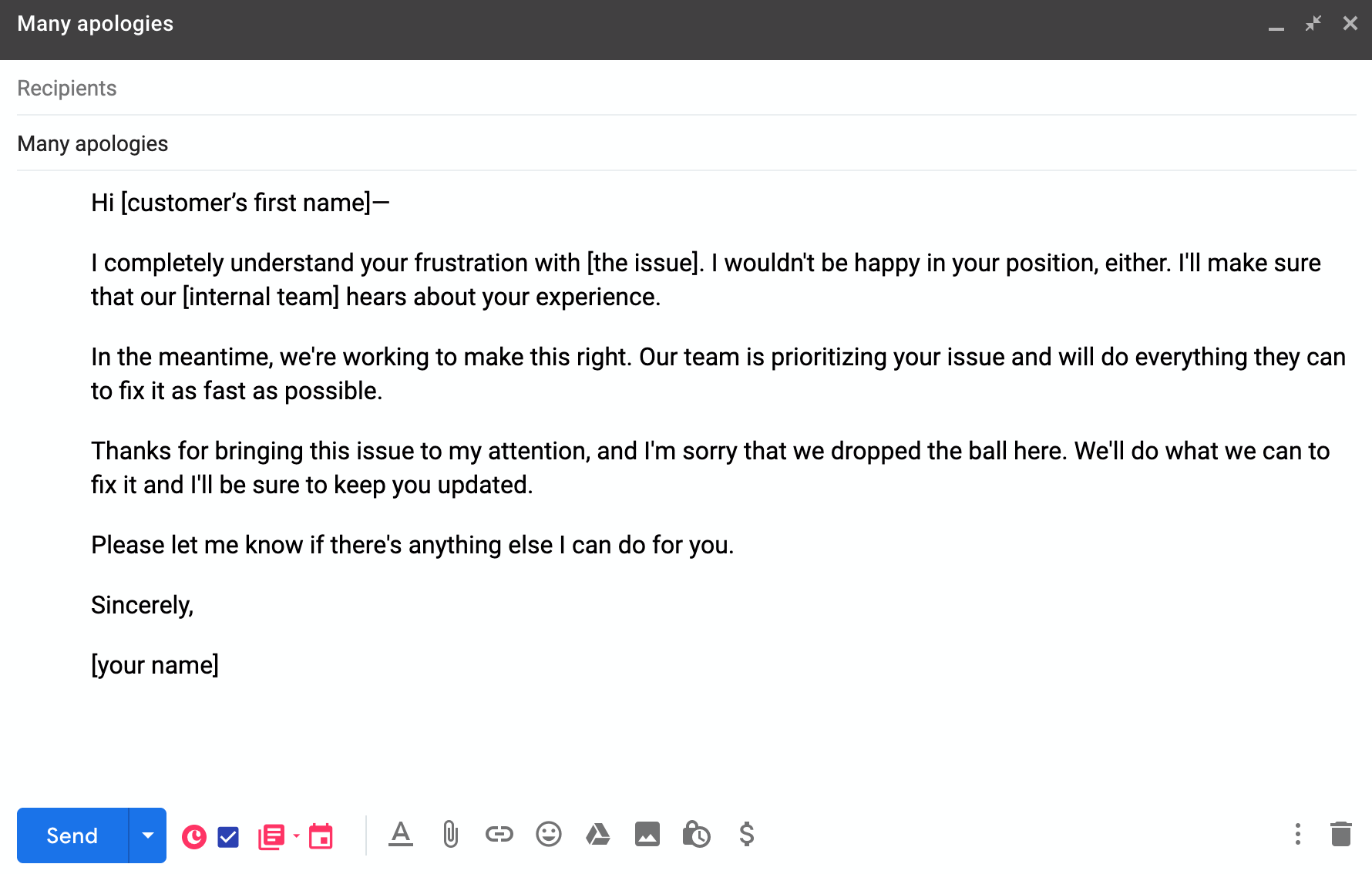

Virtual assistant compared to FHA versus Conventional Research

You can understand why individuals do prefer an effective Virtual assistant mortgage if they have eligible armed forces services: down pricing, zero down payment, and no monthly financial insurance.

Va Financing: Ignore This package When you yourself have No Military Services But Discover Carefully If you

If you have no army services, you do not need to study up on Va fund. Because they offer great terms and conditions, you really must have served become qualified, zero conditions.

Virtual assistant Loan Gurus

Earliest, that it financing boasts down pricing than FHA otherwise antique. According to Optimal Blue, a mortgage software company one to tracks pricing around the tens of thousands of loan providers, rate averages into the very first one-fourth of 2023 are as follows:

Va Financing Downsides

One of the few cons for the Virtual assistant financing would be the fact it needs an initial funding commission from dos.15% of your loan amount (higher to own recite profiles). That is $6,450 into a $three hundred,000 loan. This fee are wrapped towards financial.

Additional problem with these finance would be the payday loans no bank account Byram CT fact providers might not deal with Virtual assistant offers within the competitive avenues. Brand new Agencies off Veterans Factors imposes far more stringent assets criteria and that causes the seller and also make solutions in advance of closing.

Whom Should get An FHA Mortgage?

FHA fund are great for these having a small down payment and you may a middle-to-lower credit score of about 680 otherwise straight down.

Note: To own a deeper dive to your FHA fund rather than antique money, come across FHA vs Old-fashioned Financing: That is Most readily useful Getting Homebuyers?

FHA Mortgage Masters

FHA fund be flexible with regards to lower borrowing from the bank. The federal government makes sure lenders facing borrower default. In turn, loan providers agree a greater set of debtor users.

Concurrently, FHA prices function better for many all the way down-borrowing from the bank individuals. Old-fashioned fund away from Fannie mae and you may Freddie Mac computer demand exposure-created charges that translate to raised cost. Those who work in down borrowing from the bank levels pay a lot more. Both, far more.

FHA is one-price suits the with regards to prices. Some one which have an effective 740 get will pay a comparable speed since the some one that have an effective 640 get (although some lenders demand their unique high costs having down ratings).

But not, conventional can still end up being your top bet whenever you are inside the a beneficial low income group, as the might be chatted about less than.

FHA Financing Cons

Very first, FHA finance feature an upfront mortgage advanced of 1.75% of one’s loan amount. This can be equivalent to $5,250 for the a $300,000 mortgage and can become covered with the loan. That it advances the borrower’s fee and loan balance.

Additionally, FHA monthly financial insurance is due provided brand new homebuyer keeps the mortgage. Traditional home loan insurance falls out of when the debtor are at 20% equity. With FHA, the brand new borrower has to re-finance off FHA to your a conventional financing to remove mortgage insurance policies.

Which Need to have A conventional Mortgage?

If you’re traditional financing wanted as little as 3% off, people with huge down costs 5-20% becomes a knowledgeable cost and home loan insurance policies profile.

Antique Financing Advantages

Basic, traditional fund do not require an upfront home loan insurance coverage payment, saving the debtor more $5,000 into the a great $3 hundred,000 loan compared to the FHA.

2nd, traditional loans has actually cancelable personal financial insurance rates (PMI). You might demand you to definitely financial insurance policies come-off when you arrived at 20% security. PMI immediately drops out of in the 22% collateral.

Keep in mind that we said traditional finance score very costly of these which have all the way down credit scores? There clearly was a giant exemption.

This type of agencies waive all exposure-established loan charge to have very first-date consumers just who make no more than 100% of their urban area average money otherwise 120% during the higher-prices portion. These types of charge are known as Mortgage Height Rate Customizations or LLPAs.

For instance, a high-money or recite buyer which have an effective 650 credit score and you can 5% off manage typically pay a fee comparable to step 1.875% of loan amount, translating to help you a rate regarding 0.50-1% higher. Although fee was waived having modest-earnings basic-date customers, producing a good rate discount.

Once the a consumer, usually do not attempt to figure out if FHA or old-fashioned usually give a far greater rates otherwise lower commission. You’ll find way too many products within gamble. Alternatively, inquire about both rates from your bank.

Antique Loan Cons

People who have high personal debt-to-income (DTI) ratios, straight down credit scores, and you can spottier employment record ple, say somebody enjoys an effective 52% DTI, meaning 52% of their revenues goes into monthly loans costs plus their upcoming mortgage repayment. It probably will not be eligible for a traditional mortgage, but may very well qualify for FHA.

What type can you prefer? Va, FHA, or Antique?

Look at your qualification per financing sort of, following inquire about monthly and you will upfront will cost you toward funds to own you be considered.