Expertise Va Money

Virtual assistant financing is actually a pivotal economic unit made to assist experts, solution players, in addition to their family go homeownership. Such money, supported by new U.S. Department out of Pros Things, make an effort to offer significantly more available and versatile mortgage options than just old-fashioned money. So you proceed the link can qualify, candidates have to fulfill certain qualification standards according to its period of services, duty updates, and you can profile off services. There is also the newest eligibility to possess enduring spouses not as much as certain standards. This short article examines some great benefits of an excellent Va Loan, brand new qualifications standards, additionally the application process in the Southern Colorado.

Benefits associated with Va Lenders

Virtual assistant mortgage brokers promote several benefits in order to eligible experts, service members, in addition to their families. One to trick work with is the no-deposit requirement, which enables accredited individuals to finance 100% of one’s residence’s really worth instead of preserving for a down-payment. This particular feature can also be rather simplicity the way to homeownership having experts within the South Colorado.

- Another significant perk is the fact Va fund none of them private financial insurance policies (PMI), hence preserves most monthly costs generally speaking needed for traditional finance whenever this new down payment is actually lower than 20%. This specific factor makes monthly premiums far more in check.

- Va financing basically incorporate aggressive interest rates and much more versatile borrowing from the bank standards, that will cause nice a lot of time-name deals. Since government backs Va loans, lenders suppose quicker chance, usually permitting them to offer lower interest rates and a lot more lenient credit standards than traditional financing.

Borrowers benefit from down settlement costs and can prepay its financial instead penalty. It liberty might help veterans spend less over the longevity of the mortgage and you can pay-off their houses in the course of time if they wanna. Such positives create Va financing an excellent option for individuals who meet the requirements.

Eligibility to own Va Money

![]()

You will get a certificate of Eligibility to have a good Virtual assistant loan for those who don’t found a beneficial dishonorable launch and you will meet the minimal active-obligations solution standards once you offered.

- Adversity, or

- The handiness of government entities (you really must have served at the least 20 days out of a two-season enlistment) or

- Very early out (you really need to have offered 21 days off a two-12 months enlistment) or

- Loss of push, otherwise

- Certain diseases, or

- A help-linked handicap (a disability related to your military service).

- Lowest active-obligation provider getting service people: at least 90 persisted days at once without some slack in-service.

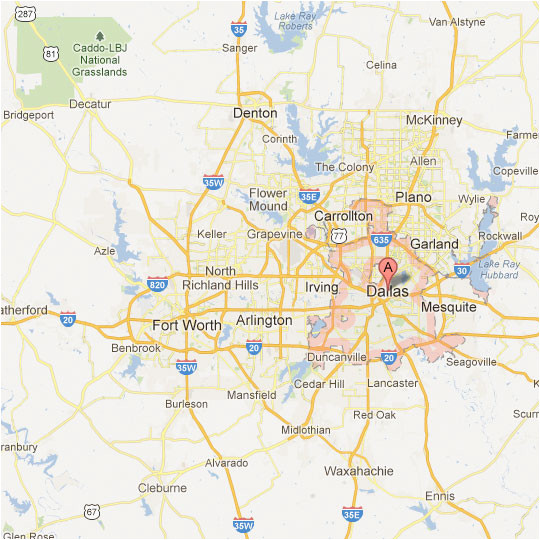

Virtual assistant Loan application Techniques inside Southern area Texas

Trying to get a Va mortgage in the Southern area Colorado involves several secret measures. The method starts with obtaining a certification from Qualifications (COE), which is crucial within the deciding your own eligibility towards the Virtual assistant fund during the South Tx. You can get your own COE from VA’s eBenefits portal or because of the working with an approved lender eg Higher County Financial.

Consult a skilled mortgage lender to make sure you’ve got all of the the necessary documentation in a position. Which personalized recommendations makes the application procedure much easier and efficient.

Virtual assistant mortgage constraints differ of the location, along with McAllen and you will encompassing areas, the newest limitations have decided predicated on median home prices. Wisdom such restrictions helps you recognize how far you could potentially obtain. You could get in touch with local positives such as Juanita Mendoza from the Higher Condition Financial to have more information in these limits and you can personalized recommendations.

Promoting Their Va Home loan Positives

Va lenders give several experts, together with no advance payment, no private mortgage insurance rates requirement, and you may competitive rates of interest. This type of professionals make it more comfortable for pros in order to safer homeownership rather than the fresh economic barriers that antique money will establish. Special apps and you will direction, particularly Rate of interest Avoidance Re-finance Finance (IRL) and Modified Housing Grants, give tailored help for your needs.

Experts can be make use of readily available resources and you may direction programs to maximize its loan masters. Whether seeking to assistance from knowledgeable positives otherwise asking homes advisors, providing hands-on measures is also facilitate a smoother app processes.

Reaching homeownership while the a seasoned is not just an aspiration but an attainable objective toward right help and you can recommendations. Influence your Virtual assistant financial advantages to generate a secure and you can comfy upcoming on your own and your members of the family.

Are you currently an experienced in Southern Texas trying to safer an effective household which fall? Realize why Va Fund regarding Better County Financial might possibly be your own prime services. All of our custom service and you can pro recommendations make techniques simple and hassle-free. Learn more about Virtual assistant Financing at the Better State Financial and also been today! Empower your financial upcoming which have a financial you to definitely undoubtedly cares from the your position.